Společnost First Guaranty Bancshares Inc (NASDAQ: FGBI) oznámila za první čtvrtletí zisk na akcii ve výši -0,49 USD, což je o 0,79 USD méně, než odhadovali analytici (0,30 USD). Tržby za čtvrtletí dosáhly 54,46 mil. USD, zatímco konsensus odhadoval 27,9 mil. USD.

Cena akcií společnosti First Guaranty Bancshares Inc uzavřela na 8,85 USD. Za poslední 3 měsíce vzrostla o 7,53 % a za posledních 12 měsíců poklesla o 13,49 %.

Společnost First Guaranty Bancshares Inc zaznamenala za posledních 90 dní 0 pozitivních revizí EPS a 1 negativní revizi EPS.

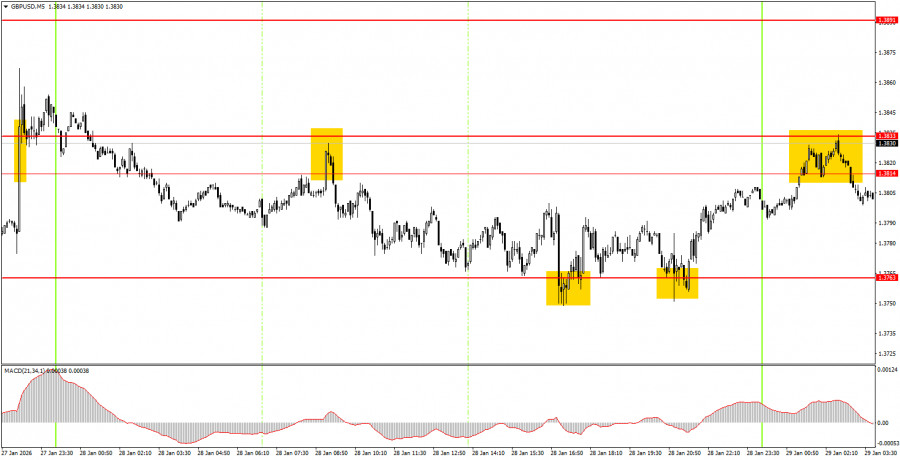

The GBP/USD pair also corrected on Wednesday to the nearest support level of 1.3763. Throughout the day, the decline of the British pound was purely technical, with no significant events or reports in either the UK or the US. In the evening, when the FOMC meeting concluded, it became clear that the central bank is generally not opposed to resuming the monetary policy easing cycle as early as March, but this could be hindered by a "shutdown" in America that may begin on February 1. In this case, many government bodies and institutions will be sent on their second vacation in the past six months, and the FOMC will be deprived of key statistics for an indefinite period. Powell warned that without statistics, the central bank is unlikely to make blind decisions. Thus, everything depends on the "shutdown," but the British pound has shown no concern about this. On Thursday morning, it is once again located near the highest values of the last few years.

On the 5-minute timeframe, several excellent trading signals were formed on Wednesday. During the European trading session, quotes bounced off the area of 1.3814-1.3833, then reached 1.3763 in the American session, bouncing off it twice. This signal could have been well executed by beginner traders with a short position to make a profit. The two bounces from the 1.3763 level were unlikely to be traded, though the trading signal was profitable despite the FOMC meeting.

On the hourly timeframe, the GBP/USD pair has turned upward, suggesting an increase in the British pound in the coming weeks. There are no global factors driving medium-term dollar growth, so we expect the continued global upward trend of 2025 to push the pair toward 1.4000 in the near future. Donald Trump's policy still does not suggest any strengthening of the American currency.

On Thursday, beginner traders may consider new short positions if the pair bounces from the 1.3814-1.3833 area, with a target at 1.3763. A consolidation above the area of 1.3814-1.3833 will allow for opening long positions with a target of 1.3891-1.3912.

On the 5-minute timeframe, trading levels to consider now include 1.3259-1.3267, 1.3319-1.3331, 1.3365, 1.3403-1.3407, 1.3437-1.3446, 1.3484-1.3489, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3763, 1.3814-1.3832. No significant events are scheduled for Thursday in the UK and the US, so all attention will be on Trump and technical factors today.

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.

LINKS RÁPIDOS