Yesterday, stock indices ended the day in the green. The S&P 500 rose by 0.50%, while the Nasdaq 100 added 0.43%. The industrial Dow Jones jumped by 0.64%.

The stock market continued its upward momentum for the fifth consecutive session, while the currency market stabilized after a volatile Monday, as traders returned some stability following speculation about potential interventions aimed at strengthening the yen.

The MSCI All Country World Index, one of the broadest measures of the global stock market, came just short of its record high. US stock index futures suggest that the rally will continue in both the American and European markets after the Wall Street indices' rise on Monday.

The yen slightly weakened after two days of gains against the dollar amid speculation about possible coordination of currency interventions between the US and Japan, while gold and silver traded near their record highs.

The latest trading sessions have been marked by heightened volatility across all assets, driven by upheavals in the Japanese bond market and speculation over potential interventions in the yen. The focus is now shifting to the Federal Reserve's decision on monetary policy, which is expected to be announced on Wednesday, and the earnings reports of the largest tech companies, which will assess the sustainability of the AI-driven rally.

Investors are keenly awaiting a speech by Federal Reserve Chair Jerome Powell, hoping for hints about the regulator's next policy steps. The market is almost certain that interest rates will remain unchanged, but any signals suggesting the possible resumption of monetary easing could trigger a new wave of stock price growth. The key question remains: how satisfied is the Fed with the current inflation dynamics, and is it prepared to adopt a wait-and-see stance while evaluating incoming data?

CEO David Solomon stated that, economically, everything was shaping up favorably. He cited favorable conditions in global markets and emphasized the stimulative fiscal policies and positive regulatory trends.

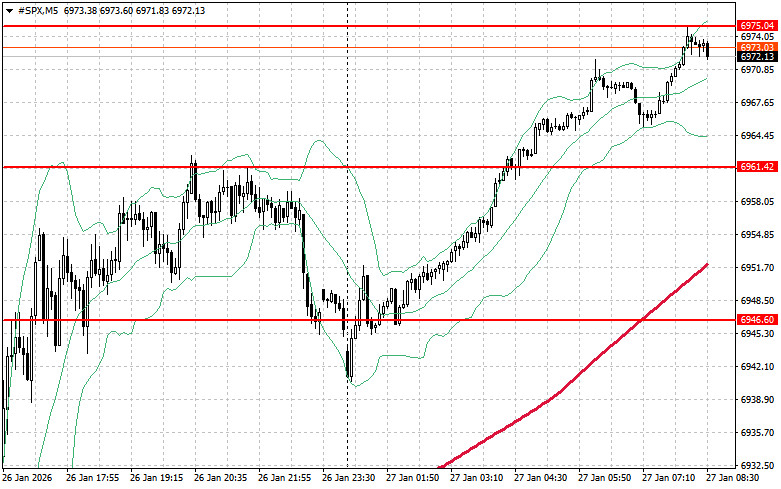

As for the technical picture of the S&P 500, the main challenge for buyers today will be overcoming the nearest resistance level of $6,975. This will help to signal further growth and open the path for a move to the next level at $6,993. Another priority for bulls will be to maintain control over $7,013, strengthening buyers' positions. If the market moves downward due to reduced risk appetite, buyers must assert themselves around $6,961. A break below this level would quickly push the instrument back to $6,946 and open the way to $6,930.

LINKS RÁPIDOS