USDX: Considering the current situation and investor expectations, the US dollar will continue to trade under pressure in the near term. A breakout below the round level of 99.00 will confirm the resumption of the downtrend.

Futures on the US dollar index were trading at 99.00 in the first half of today's European trading session, as investors were assessing macroeconomic data and the Fed's next policy moves. According to data from the Chicago Mercantile Exchange (CME) FedWatch Tool, the probability of a rate cut at the Fed's December meeting has changed from 85.6% to 89.2%.

Drivers of market sentiment

What's on for today?

Market participants will evaluate the private sector employment data from Automatic Data Processing (ADP) today. A rise of only 5,000 new jobs is expected (down from 10,000 yesterday) following 42,000 in October. The ADP report will be published at 1:15 PM (GMT), and shortly after (at 3:00 PM), the ISM services PMI report for November will be released (this indicator assesses the state of the services sector in the US economy, which accounts for about 80% of US GDP. Therefore, the publication of these data has a significant impact on the dollar's dynamics. A result above 50 and an increase in the index are seen as positive factors for the USD. The forecast is 52.1, down from 52.4 in October. Although the index remains in an expansion zone (above the 50 mark), its relative decline, coupled with previously weaker data released earlier this week, may be negatively received by market participants. These data underline the gradual deterioration of the US economic situation, reinforcing arguments in favor of further Fed rate cuts.

Technical picture

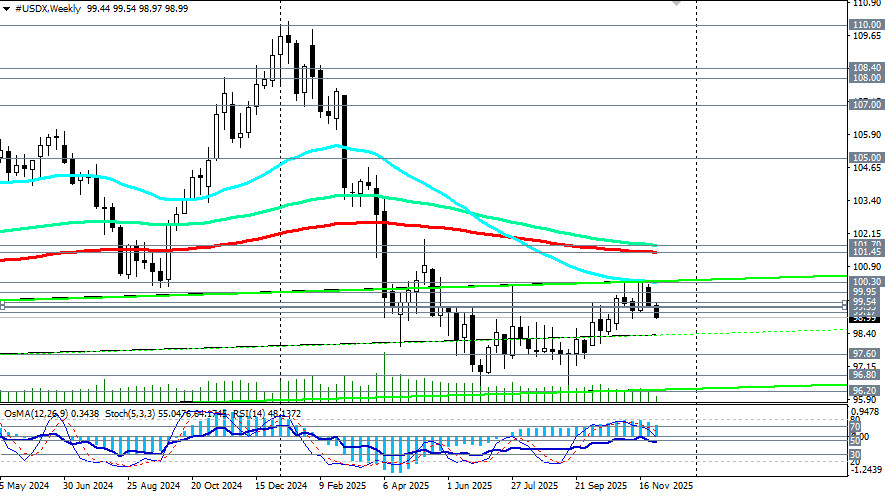

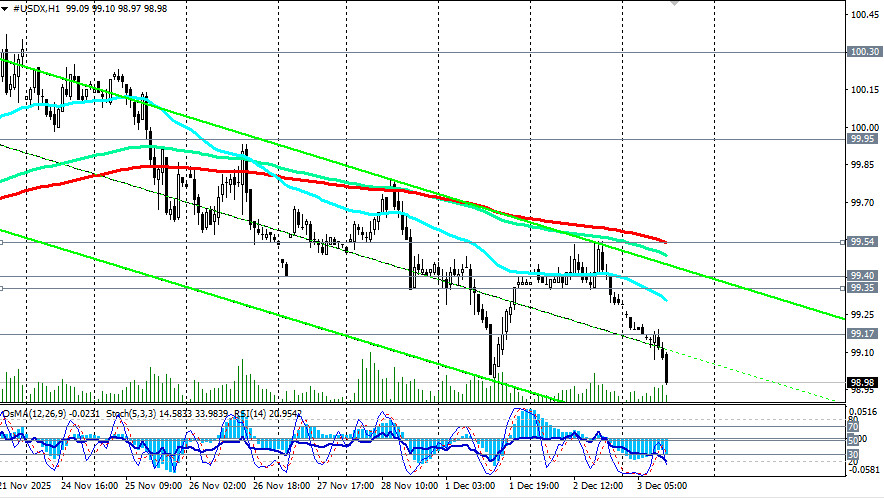

The USDX continues to decline, moving within short-term, medium-term, and long-term bearish markets, respectively below the 200-period moving averages on the 1-hour chart (99.54), daily chart (99.95), and weekly chart (101.45).

Technical indicators (in our case, RSI, OsMA, and Stochastic) on the daily and weekly charts also recommend short positions.

In the alternative scenario, the price will need to overcome a strong resistance zone around the levels of 99.35 (200-period moving average on the 4-hour chart), 99.40 (144-period moving average on the daily chart), and 99.54. Only a breakout of the 99.95 level will confirm the entry into a medium-term bullish market zone, enhancing the potential for further USDX growth. A breakout below the "round" level of 99.00 will confirm the resumption of the downtrend.

Forecasts and recommendations

Most economists and major investment banks predict further rate cuts at the Fed's December meeting. They believe that a 25-basis-point cut will lower borrowing costs and support the economy. However, if subsequent statistics from the US are stronger than expected, the regulator may reconsider its decision. Remember, the US central bank meeting will take place next week. Interestingly, the head of the agency, Jerome Powell, while speaking at a discussion on George Shultz (an American statesman who held various positions in government and influenced US policy in different areas, including the economy) at Stanford University, noted that the Fed is ready for policy easing, but everything will depend on incoming statistics as well as persisting inflationary risks.

Conclusion Thus, considering the current situation and investor expectations, the US dollar will remain under pressure in the near term. Investors are advised to closely monitor the publication of economic data and the Fed's announcements to make informed decisions.

SZYBKIE LINKI