Circle Internet Group Inc. spolu s některými svými akcionáři získala v rámci rozšířené primární emise akcií (IPO) téměř 1,1 miliardy dolarů, uvádí Bloomberg s odvoláním na anonymní zdroj. Cena akcií byla stanovena nad tržní hodnotou, což naznačuje rostoucí přijetí emitentů stabilních kryptoměn.

Ve středu údajně společnost vydávající stablecoiny a její podporovatelé, včetně spoluzakladatele a generálního ředitele Jeremyho Allairea, prodali akcie za 31 dolarů za kus. Počet akcií v základní nabídce byl zvýšen na 34 milionů, jak vyplývá z dokumentů podaných téhož dne u americké Komise pro cenné papíry a burzy (SEC).

Dříve byla nabídka uvedena na trh za 27 až 28 dolarů za akcii a již jednou byla navýšena. Na základě akcií v oběhu uvedených v podání by tržní hodnota Circle při ceně 31 dolarů za akcii činila 6,9 miliardy dolarů.

Podle agentury Bloomberg by společnost při zohlednění opcí na akcie pro zaměstnance, omezených akciových jednotek a warrantů měla plně zředěnou hodnotu přibližně 8,1 miliardy dolarů.

The EUR/USD currency pair showed no notable movements on Friday, and the day's overall volatility was 37 pips. Thus, there is practically nothing to analyze. There is a clear upward trend on the daily timeframe that began in January of last year, while a correction has been ongoing on the 4-hour timeframe for several weeks. Therefore, the conclusion is straightforward: we need to wait for the correction to end and for a new wave of growth of the European currency.

Unfortunately, under the current circumstances, it is difficult to say when the trend will resume. It is worth noting that the market in 2026 is largely ignoring macroeconomic reports, focusing only on global events. However, this used to apply to European or British data and "second-tier" reports in the U.S. However, last week showed that the market is no longer particularly eager to respond to even the most important key reports on America. For example, the NonFarm Payrolls report and the unemployment rate were processed quite weakly. At the same time, Friday's U.S. inflation data was ignored, even though it largely affects the Federal Reserve's monetary policy.

Why is this happening? There could be several explanations. First, there is a decreasing trust in the reliability of U.S. data. The last six months have shown that any NonFarm Payrolls figure can be revised by tens of thousands of jobs in the following month. What is the point of each report if its values are likely to require serious adjustments?

Secondly, there is the inconsistency of the published data. The JOLTS and ADP reports showed minuscule values in January. Non-farm Payrolls significantly exceeded expectations, collapsed in 2025, and, as a bonus, the unemployment rate decreased. How should these data be interpreted?

Thirdly, global processes occupy traders' minds far more than ordinary data. Donald Trump's policy is not only destructive for America. Currently, there is active discussion in the U.S. about yet another possibility of impeaching the president, the next Congressional elections are eagerly anticipated, Trump's actions regarding Iran are awaited, and the consequences of China's abandonment of American treasury bonds are being analyzed. There are global, structural changes underway that are far more significant than macroeconomic data.

This week in the European Union, a few events and reports stand out. But what can we expect from two speeches by Christine Lagarde, given that the head of the European Central Bank clearly indicated in her last speech that the current level of inflation satisfies the ECB and that there are no plans to lower or raise rates in the near future? Reports such as industrial production or business activity indices in the services and manufacturing sectors are interesting data, but what kind of reaction should we expect from these data? At best, 50 pips, which will not have any global impact. Thus, the market is currently in a complicated position, caught between two fires. On one side is the weakening dollar, once the "world reserve currency" and "safe haven." On the other side is global uncertainty.

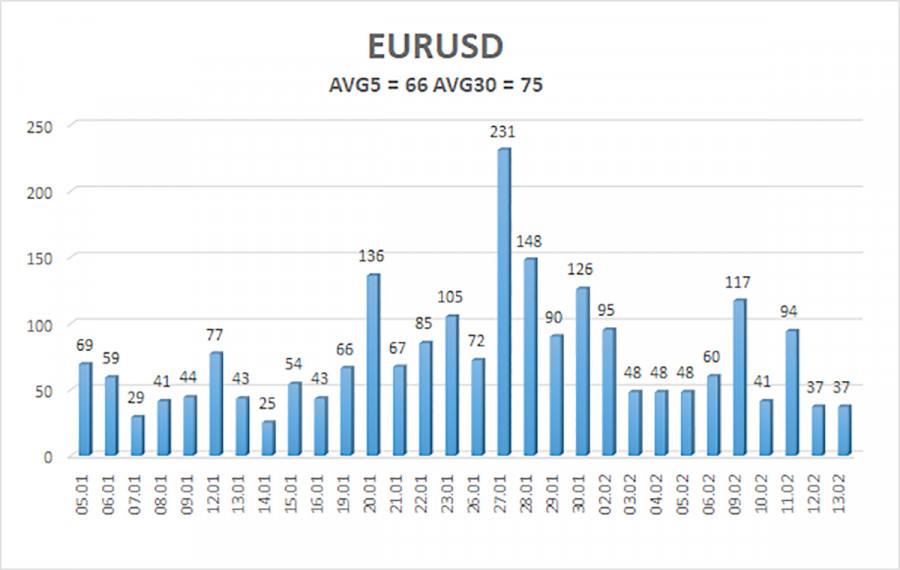

The average volatility of the EUR/USD currency pair over the last 5 trading days as of February 16 is 66 pips, which is considered "average." We expect the pair to trade between 1.1802 and 1.1934 on Monday. The upper channel of the linear regression is upward, indicating further growth in the euro. The CCI indicator entered the overbought area, signaling a possible pullback.

S1 – 1.1841

S2 – 1.1719

S3 – 1.1597

R1 – 1.1963

R2 – 1.2085

R3 – 1.2207

The EUR/USD pair continues to correct within an upward trend. The global fundamental background remains extremely negative for the dollar. The pair spent seven months in a sideways channel, and it is likely time to resume the global trend of 2025. There is no fundamental basis for the dollar's long-term growth. Therefore, all the dollar can hope for is a flat or a correction. When the price is below the moving average, small shorts with a target of 1.1719 can be considered purely on technical grounds. Above the moving average line, long positions remain relevant with targets of 1.1963 and 1.2085.

Linear regression channels help determine the current trend. If both are pointing in the same direction, it means the trend is strong at the moment;

The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

Murray levels are target levels for movements and corrections;

Volatility levels (red lines) represent the likely price channel in which the pair will spend the next 24 hours, based on current volatility indicators;

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal towards the opposite direction is approaching.