The EUR/USD currency pair traded very sluggishly on Wednesday, as if it were reluctant. As usual, during the American trading session, we observed more interesting movements, driven by the US macroeconomic backdrop. What should we discuss first? Certainly, the report on European inflation. According to the January results, the consumer price index slowed to 1.7%, as predicted. This rate is likely not critically low, but it is close to that mark. Recall that the ECB risks facing two major challenges in 2026: a high euro and low inflation. Moreover, the high euro could be the reason for the low inflation.

If the European currency rises against its competitors (particularly against the US dollar), it reduces European exports. European companies and factories earn less revenue and are forced to cut production and staffing. As a result, the economy slows further. A slowing economy leads to lower inflation. And low inflation is, in itself, a problem for the ECB, which has been striving to achieve a stable 2% over the past year.

What is the exit from this situation? The most prosaic exit of all possible is to lower rates. Lowering rates would accelerate inflation and weaken the euro. In fact, the second conclusion can be easily contested under current circumstances. Recall that in 2025, the ECB actively lowered rates in the first half of the year, yet the European currency still rose dramatically. Therefore, if Donald Trump continues to adhere to his entirely unpredictable policies, it is by no means certain that a reduction in the ECB's key rate will lower the euro's value as effectively as the ECB would like.

In general, the Eurozone is facing new challenges, including one challenge: Donald Trump. Today, Christine Lagarde will speak following the ECB meeting, so we can expect comments regarding monetary policy and inflation. The ECB president may clarify everything and provide the market with the necessary guidelines. However, we reiterate that even the new easing of the ECB's monetary policy does not guarantee a drop in the European currency. It is not only about the ECB. The Fed, for example, is also expected to cut the key rate at least twice this year. If Trump manages to exert control over the Fed through Kevin Warsh and by dismissing all officials he dislikes, the rate cuts could be much more substantial.

If the Fed cuts rates even just twice and the ECB also cuts rates twice, what reason would the market have to dump the euro in favor of an unstable dollar? Thus, Europe will likely have to accept falling exports, declining inflation below target, slowing economic growth, and a rising currency. The cards in Trump's hands, enabling him to ensure the dollar's decline, are significantly stronger.

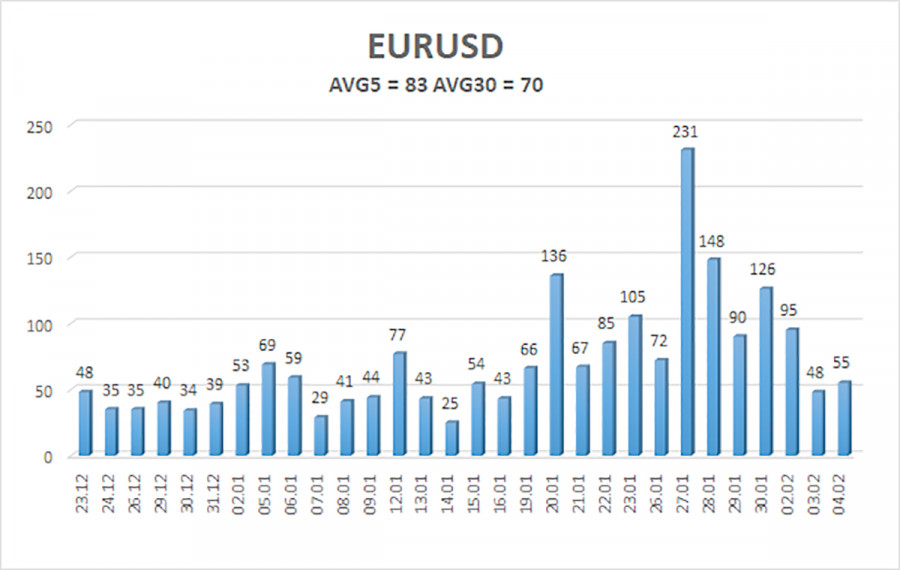

The average volatility of the EUR/USD pair over the last five trading days as of February 5 is 83 pips, which is considered "average." We expect the pair to move between 1.1710 and 1.1876 on Thursday. The upper linear regression channel is pointing upward, indicating further growth in the euro. The CCI indicator has entered the overbought zone and formed two "bearish" divergences, signaling an impending pullback.

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

R1 – 1.1841

R2 – 1.1963

R3 – 1.2085

The EUR/USD pair continues a relatively strong correction within the upward trend. The global fundamental background remains extremely negative for the dollar. The pair spent seven months in a sideways channel and now seems ready to resume the global trend of 2025. There is no fundamental basis for the dollar's long-term growth. If the price is below the moving average, small short positions may be considered with a target at 1.1719 on purely technical grounds. Long positions with targets of 1.1963 and 1.2085 remain relevant when the price is above the moving average.