The EUR/USD currency pair continued to correct slightly on Thursday, but it does not seem eager to move far from the recent four-year highs. Recall that on Wednesday evening, the results of the first Federal Reserve meeting of the year were announced, and honestly, the feelings after this event are mixed. On the one hand, the market was confident that no significant decisions would be made and that Powell would make no announcements. On the other hand, there was a desire to see Powell react to what is happening around him.

It should be noted that Powell's term as Fed Chair expires in May. However, he may remain on the FOMC until 2028, acting as a voting member. Naturally, Donald Trump would like to avoid such a scenario, and we do not know Powell's stance on this issue. And we did not find out on Wednesday evening. It is also worth mentioning that Powell commented on the situation for the first time this year amid Trump's aggression towards him, stating that he is under pressure from the administration regarding his refusal to lower the key rate as Trump demands. It would have been useful to hear the Fed Chair's comments on this matter and regarding the progress of the legal investigation.

However, in essence, Powell did not convey anything new, important, or interesting. He noted that the US economy is doing well, the labor market has begun to recover, and the unemployment rate is declining. However, these three indicators need more time to fully reflect the 0.75% rate cut at the end of last year. Powell also pointed to the elevated inflation rate, which prevents the Fed from making hasty decisions to ease monetary policy. Essentially, Powell reiterated his sacred phrase that "decisions will be made from meeting to meeting based on macroeconomic data."

Powell also mentioned that a new "shutdown" could begin in America on February 1, making it more challenging for the Fed to make a rate decision in March due to the absence of relevant and reliable economic data. At the end of his speech, he urged the Fed to remain apolitical, as it is the guardian of financial stability. Of the entire FOMC, two representatives voted for a rate cut. It is not surprising that one of them was Stephen Miran and the other was Christopher Waller. It is worth recalling that Miran was appointed to his position by Donald Trump just six months ago, while Christopher Waller is vying to become the new Fed Chair. It is surprising that Michelle Bowman, who also sought the Fed Chair position and was appointed by Trump, is not on this list. Is she no longer a contender?

The results of the Fed meeting can be summed up in one word – "bland." Therefore, the market reaction was virtually non-existent. Traders continue to closely monitor all statements and remarks by Trump, as they are the primary drivers of the currency market in 2026.

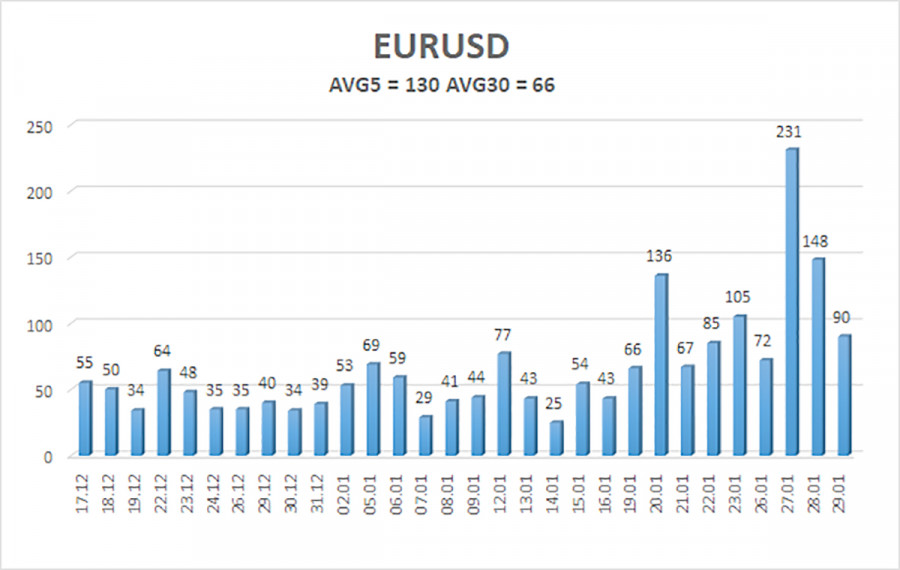

As of January 30, the average volatility of the EUR/USD currency pair over the last 5 trading days is 130 pips and is characterized as "high." We expect the pair to trade between 1.1820 and 1.2080 on Friday. The upper linear regression channel is pointing upward, indicating further euro appreciation. The CCI indicator entered the overbought area last week, and this week formed a "bearish" divergence, which warned of an upcoming pullback. Note how volatility increased as soon as the pair exited the sideways channel of 1.1400-1.1830.

S1 – 1.1841

S2 – 1.1719

S3 – 1.1597

R1 – 1.1963

R2 – 1.2085

R3 – 1.2207

The EUR/USD pair continues its upward movement, which has sharply intensified recently. The global fundamental background remains extremely negative for the dollar. The pair spent seven months in a sideways channel, and the time to resume the trend has likely arrived. The dollar lacks a fundamental basis for long-term growth. When the price is below the moving average, small shorts can be considered with a target of 1.1719 on purely technical grounds. Above the moving average line, long positions remain relevant with targets of 1.2085 and 1.2207.

RYCHLÉ ODKAZY